Donations?

If you like this blog you can send it to a friend.

Thank you

Thursday, October 29, 2009

Two new sells for us

Wednesday, September 30, 2009

Updated Stop Loss Orders

- APOL: $64.94

- BUCY: $30.33

- CSKI: $12.81

- ENDP: $21.88

- EROC: $3.47

- LHCG: $26.37

- WDC: $33.60

Monday, September 21, 2009

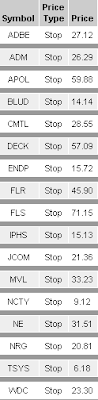

New Stop Loss Orders

Thursday, September 17, 2009

New stop loss prices, a question and the strange case of MAXY

I sold MAXY, but I did not want to. Let me explain: I use eTrade for my trading and there is a technical detail that made me sell MAXY yesterday. eTrade uses Ask Prices for buy orders and Bid Prices for sell orders. So, since MAXY's Bid Price went under $6.63 my order was executed at $6.83. The day low was $6.75, thus higher than our stop loss level. I do not know if other trading platform manage stop loss orders in a different way, but I consider this as an accident that can happen.

The bottom line is that I take home a 9.5% loss on MAXY. If you still have it, keep the stop at $6.63.

Current portfolio and updated stop loss prices

The new stop prices I would suggest are:

- APOL: Stop at $61.14

- BUCY: Stop at $29.13

- CMTL: Stop at $33.27

- ENDP: Stop at $21.66

- EROC: Stop at $3.23

- LHCG: Stop at $24.02

- MIR: Stop at $15.75

- WDC: Stop at $32.30

The question

I received the following question in a comment:

Quick question, how effective are stop losses? I assume you're putting a stop limit on these prices, but on some of the riskier stocks, if the stock opens up really low, the stock will automatically sell. Is that a good strategy?

I try to answer, but my opinion is not necessary matching your idea.

Stop Losses are statistically effective. I mean they usually work. I read books and made simulations and I found the method I use to calculate stop losses works well (on average). It happens stop losses are violated and stocks are sold, and after that they continue to go up. For me it is just part of the game.

There are basically two ways to manage stop losses:

- Set stop loss orders (this is what I do). If the price goes down during the day the order is executed automatically. Then the price can go up again in a dragonfly doji.

- Simulate stop losses. Set alerts on stocks at the stop loss level you want. If the price goes down you get an email. At the end of the day you check. If the close price is below your stop loss then you sell the following day on open. What I don't like in this approach is that a stock it may happen to lose 30% in a day. If you use this method you sell the day after losing 30%, while with method 1 you sell during the day when you lose, let's say, 15%.

Your choice. I hope this can be of any use for you.

Monday, September 14, 2009

Current Portfolio and Update Stop Loss Orders

Current Portfolio

Stop Loss Orders

- APOL: stop at $61.14

- CMTL: stop at $32.98

- ENDP: stop at $21.07

- LHCG: stop at $23.35

- MAXY: stop at $6.63

- WDC: stop at $31.55

Monday, September 7, 2009

A new buy and some new stop loss

Actually we should have bought it last Friday (September 4th) but I was not in front of my computer that day.

We can buy it now, or better, tomorrow, since today is Labor Day.

MAXY show a very goos PE ratio, averagePrice/Sales and good Price/Book.

It has no debt and very goos quick and current ratio (cash in pocket).

Operating margin and EBITDA are in Industry's best 20%, as ROI/ROE are.

This stock should offer us a good margin of safety.

I would suggest to set a buy order as a trailing stop at 1% (as an alternative, just buy it on market open) and set an initial stop loss at $6.63.

Updated Stop Loss Orders

- APOL Stop at $61.14

- CMTL Stop at $32.61

- ENDP Stop at $20.92

- LHCG Stop at $23.32

- WDC Stop at $31.04

- MAXY Stop at $6.63

Friday, August 28, 2009

New buy: APOL

- No debt, average quick and current ratios (1.40) in industry

- Better than industry average P/E

- Very good profitability (Operating and EBITDA margins in industry's best 20%)

- Very good ROE/ROI compared to industry

- Good EPS and Sales growth

- Stochastic oscillator gave a buy signal, confirmed by the Exponential Moving Average (20 days) crossing.

Wednesday, August 19, 2009

Coming back

In fact my family grew a few weeks ago and I had to work night and day to take care of my newly arrived little lady.

It is now time to restart our trading activity. In the meanwhile, after DECK, ADBE and FLR, we sold APOL, DISH, NRG and MVL.

I am sorry I did not post the updated stop loss prices, but if you followed my free stop loss calculator you should have sold at prices similar to mine.

Let's quickly review our last trades:

- We sold APOL at $64.7 on July 13th. We bought it at $62.87 on May 19th for a modest 2.9% gain.

- Bad luck with DISH. We bought it at $15.89 and sold it at $14.33 for a 10% loss. It then went over $19, but I really had no time to follow it.

- We sold NRG at $22.3 on July 21st, after having bought it at $19.56 on May 4th for a 14% gain.

- Finally, on August 17th we sold MVL at $37.87. We bought it on March 24th at $24.35 for a good 55% gain.

On average we made a 15% gain on these four trades.

That's all for now. Hopefully this week i will be able to analyze some new stocks. But at the same time let' keep an eye on the markets. They look very uncertain to me...