On July 8th we sold DECK at $64.18.

We bought it on May 29th at $57.08 and our total gain was 12.4%.

From March to May 2009 we already traded DECK for a 6.7% gain.

Donations?

This blog is free. It is an experiment: I simply share my actions with anybody interested.

If you like this blog you can send it to a friend.

Thank you

If you like this blog you can send it to a friend.

Thank you

Showing posts with label DECK. Show all posts

Showing posts with label DECK. Show all posts

Friday, July 10, 2009

Monday, June 22, 2009

Friday, May 29, 2009

New Buys: DECK and JCOM

May 29th 2009

I would suggest to buy DECK again and also JCOM.

We sold DECK some time ago because it broke our stop loss at around $54.50. It is currently higher, but still with good fundamentals.

I would suggest an initial stop loss at $49.27

JCOM is new for us. It is a little expensive, with a PE ratio a little higher than its industry average. It also has an average growth rate, but has high ROI/ROE, high profit margins and a strong financial position.

I would suggest an initial stop loss at $19.96

I would suggest to buy DECK again and also JCOM.

We sold DECK some time ago because it broke our stop loss at around $54.50. It is currently higher, but still with good fundamentals.

I would suggest an initial stop loss at $49.27

JCOM is new for us. It is a little expensive, with a PE ratio a little higher than its industry average. It also has an average growth rate, but has high ROI/ROE, high profit margins and a strong financial position.

I would suggest an initial stop loss at $19.96

Wednesday, May 13, 2009

DECK losing ground

May 13th 2009

It seems like selling DECK yesterday was not a bad idea.

It is currently trading under $52.

It seems like selling DECK yesterday was not a bad idea.

It is currently trading under $52.

Tuesday, May 12, 2009

DECK violated its stop loss

We should have sold DECK today, since it violated it stop loss at $54.23.

We bought it at $50.81, so we gained only a 6.7% with it.

What's next? Who knows... maybe DECK will skyrocket now or maybe it will move sideways for a while.

We will watch it and may buy it again, since its fundamentals are still good.

We bought it at $50.81, so we gained only a 6.7% with it.

What's next? Who knows... maybe DECK will skyrocket now or maybe it will move sideways for a while.

We will watch it and may buy it again, since its fundamentals are still good.

Sunday, May 10, 2009

Current Portfolio

May 10th 2009

| Symbol | Last Trade | Price Paid | Gain/Loss % | Stop Loss |

| ADBE | $25.42 | $18.70 | 35.93 | $23.32 |

| ADM | $26.97 | $25.40 | 6.18 | $23.20 |

| AFAM | $31.55 | $17.41 | 81.21 | $21.22 |

| DECK | $59.00 | $50.81 | 16.11 | $54.23 |

| ENDP | $16.34 | $17.38 | -5.99 | $14.89 |

| FLR | $45.17 | $37.99 | 18.89 | $36.61 |

| FLS | $74.38 | $52.57 | 41.48 | $59.19 |

| GIGM | $6.43 | $6.53 | -1.53 | $5.64 |

| IPHS | $15.81 | $9.47 | 66.94 | $12.21 |

| MVL | $33.24 | $24.35 | 36.50 | $27.35 |

| NCTY | $9.24 | $9.30 | -0.65 | $8.10 |

| NE | $30.90 | $24.39 | 26.69 | $26.04 |

| NRG | $21.19 | $18.98 | 11.64 | $16.35 |

| RECN | $19.77 | $14.04 | 40.81 | $16.49 |

| TRLG | $21.97 | $10.53 | 108.64 | $14.01 |

| VPHM | $6.03 | $4.71 | 28.02 | $4.82 |

| WDC | $23.71 | $16.20 | 46.35 | $20.51 |

Tuesday, May 5, 2009

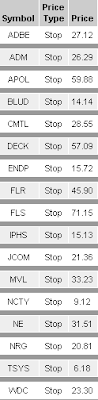

Updated Stop Loss

May 6th 2009

ADBE: stop loss $23.14

ADM: stop loss $23.20

AFAM: stop loss $20.83

DECK: stop loss $54.59

ENDP: stop loss $14.89

FLR: stop loss $36.61

FLS: stop loss $58.45

IPHS: stop loss $11.99

MVL: stop loss $26.77

NCTY: stop loss $8.10

NE: stop loss $25.42

NRG: stop loss $16.35

RECN: stop loss $16.02

TRLG: stop loss $12.97

VPHM: stop loss $4.71

WDC: stop loss $20.09

ADBE: stop loss $23.14

ADM: stop loss $23.20

AFAM: stop loss $20.83

DECK: stop loss $54.59

ENDP: stop loss $14.89

FLR: stop loss $36.61

FLS: stop loss $58.45

IPHS: stop loss $11.99

MVL: stop loss $26.77

NCTY: stop loss $8.10

NE: stop loss $25.42

NRG: stop loss $16.35

RECN: stop loss $16.02

TRLG: stop loss $12.97

VPHM: stop loss $4.71

WDC: stop loss $20.09

Current Portfolio

May 5th 2009

| Symbol | Last Trade | Price Paid | Gain/Loss % | Stop Loss |

| ADBE | $26.69 | $18.70 | 42.72 | $23.08 |

| ADM | $26.17 | $25.40 | 3.03 | $23.20 |

| AFAM | $25.96 | $17.41 | 49.10 | $20.75 |

| DECK | $59.10 | $50.81 | 16.31 | $54.23 |

| ENDP | $16.56 | $17.38 | -4.72 | $14.89 |

| FLR | $40.77 | $37.99 | 7.31 | $35.68 |

| FLS | $70.95 | $52.57 | 34.96 | $58.23 |

| IPHS | $17.12 | $9.47 | 80.78 | $11.93 |

| MVL | $31.10 | $24.35 | 27.72 | $26.83 |

| NCTY | $9.66 | $9.30 | 3.87 | $8.10 |

| NE | $30.21 | $24.39 | 23.86 | $25.21 |

| NRG | $19.48 | $18.98 | 2.63 | $16.35 |

| RECN | $20.01 | $14.04 | 42.52 | $15.78 |

| TRLG | $17.53 | $10.53 | 66.47 | $12.79 |

| VPHM | $5.42 | $4.71 | 15.28 | $4.71 |

| WDC | $24.26 | $16.20 | 49.75 | $19.86 |

Sunday, May 3, 2009

Current Portfolio

May 3rd 2009

| Symbol | Last Trade | Price Paid | Gain/Loss % | Stop Loss |

| ADBE | $27.46 | $18.70 | 46.79 | $22.84 |

| AFAM | $25.09 | $17.41 | 44.11 | $20.64 |

| DECK | $56.11 | $50.81 | 10.43 | $54.23 |

| ENDP | $16.51 | $17.38 | -5.00 | $14.89 |

| FLR | $37.73 | $37.99 | -0.68 | $35.68 |

| FLS | $69.81 | $52.57 | 32.79 | $57.82 |

| IPHS | $15.33 | $9.47 | 61.87 | $11.80 |

| MVL | $30.22 | $24.35 | 24.10 | $26.68 |

| NCTY | $9.35 | $9.30 | 0.53 | $8.10 |

| NE | $28.45 | $24.39 | 16.64 | $25.21 |

| NRG | $18.98 | $18.98 | - | $16.35 |

| RECN | $19.42 | $14.04 | 38.31 | $15.78 |

| TRLG | $16.88 | $10.53 | 60.30 | $12.79 |

| VPHM | $5.49 | $4.71 | 16.56 | $4.71 |

| WDC | $23.39 | $16.20 | 44.38 | $19.86 |

Thursday, April 30, 2009

Current Portfolio

April 30th 2009

| Symbol | Last Trade | Price Paid | Gain/Loss % | Stop Loss |

| ADBE | $26.75 | $18.70 | 42.71 | 21.75 |

| AFAM | $24.32 | $17.41 | 39.32 | 19.10 |

| DECK | $57.3 | $50.81 | 12.5 | 53.99 |

| ENDP | $17.28 | $17.38 | -0.79 | 14.89 |

| FLR | $38.2 | $37.99 | 0.33 | 35.68 |

| FLS | $64.88 | $52.57 | 23.12 | 55.36 |

| IPHS | $15.1 | $9.47 | 59.16 | 11.16 |

| MVL | $31.03 | $24.35 | 27.14 | 25.30 |

| NE | $27.97 | $24.39 | 14.44 | 24.53 |

| RECN | $19.92 | $14.04 | 41.54 | 15.12 |

| TRLG | $16.36 | $10.53 | 55.06 | 11.93 |

| VPHM | $5.59 | $4.71 | 18.44 | 4.25 |

| WDC | $22.05 | $16.20 | 35.78 | 19.24 |

Subscribe to:

Posts (Atom)