Donations?

If you like this blog you can send it to a friend.

Thank you

Friday, May 29, 2009

New Buys: DECK and JCOM

I would suggest to buy DECK again and also JCOM.

We sold DECK some time ago because it broke our stop loss at around $54.50. It is currently higher, but still with good fundamentals.

I would suggest an initial stop loss at $49.27

JCOM is new for us. It is a little expensive, with a PE ratio a little higher than its industry average. It also has an average growth rate, but has high ROI/ROE, high profit margins and a strong financial position.

I would suggest an initial stop loss at $19.96

Wednesday, May 27, 2009

New buy: GHM and CMTL

Tuesday, May 26, 2009

Unlucky with RECN

Today RECN opened very low, below our stop loss level and we sold it.

Sell price was the low of the day at $17.21 while it is now trading at $18.52.

Anyway, we bought RECN on March 11th at $14.04 and, although we could have done better, we cashed in a 22% in two months and a half.

Stop Loss

ADBE: $24.79

ADM: $24.27

APOL: $55.34

ENDP: $14.89

FLR: $39.48

FLS: $63.94

GIGM: $5.64

IPHS: $13.41

MVL: $29.80

NCTY: $8.10

NE: $27.52

NRG: $17.86

RECN: $17.54

TRLG: $18.51

TSYS: $6.18

VPHM: $5.24

WDC: $21.90

Thursday, May 21, 2009

AFAM sold

Wednesday, May 20, 2009

New Buys: TSYS and APOL

Monday, May 18, 2009

Updated Stop Loss Orders

ADM: $23.20

AFAM: $26.09

ENDP: $14.89

FLR: $38.09

FLS: $60.50

GIGM: $5.64

IPHS: $13.02

MVL: $28.27

NCTY: $8.10

NE: $26.48

NRG: $17.36

RECN: $17.17

TRLG: $17.66

VPHM: $4.96

WDC: $20.87

Wednesday, May 13, 2009

Calculate Stop Loss Prices

http://spiderman.servehttp.com/stop.jsp

NOTE: update your stop losses ONLY UPWARD.

DECK losing ground

It seems like selling DECK yesterday was not a bad idea.

It is currently trading under $52.

Updated Stop Loss

ADBE $23.40

ADM $23.20

AFAM $21.83

ENDP $14.89

FLR $36.61

FLS $59.92

GIGM $5.64

IPHS $12.60

MVL $27.79

NCTY $8.10

NE $26.37

NRG $17.28

RECN $16.69

TRLG $14.39

VPHM $4.86

WDC $20.67

Tuesday, May 12, 2009

DECK violated its stop loss

We bought it at $50.81, so we gained only a 6.7% with it.

What's next? Who knows... maybe DECK will skyrocket now or maybe it will move sideways for a while.

We will watch it and may buy it again, since its fundamentals are still good.

An update on Stop Loss orders

In this volatile market we should pay attention to protect our gains, specially for those positions on which we are gaining well.

In this volatile market we should pay attention to protect our gains, specially for those positions on which we are gaining well.Let's take our four best performers: TRLG (up 105%), AFAM (up 81%), IPHS (up 61%) and WDC (up 42%).

I would suggest to:

- Almost Family, Inc. (AFAM) move the stop loss from $21.22 to $21.45

- Innophos Holdings, Inc. (IPHS) move the stop loss from $12.21 to $12.60

- True Religion Apparel, Inc. (TRLG) move the stop loss from $14.01 to $14.37

- WESTERN DIGITAL CP (WDC) move the stop loss from $20.51 to $20.52

Monday, May 11, 2009

Correlation - Is our portfolio well diversified?

We can use correlation to evaluate how our stocks are prone to move together.

A well differentiated portfolio should have stocks that do not behave the same over time. Every day we should own stocks that win and stocks that lose (ideally more of the former and les of the latter) so that on average we gain more than the market in good times and lose less than the market in bad times.

Two stocks are perfectly correlated if there is a linear relation between them. Let's suppose to own stock A and stock B. If stock B gains X% everytime stock A gains X%, and stock B loses X% everytime stock A loses X%, then stock A and stock B have a correlation factor of 1. The same if stock B gains/loses 2, 3, 4 or n times X%. There is a linear dependency between the two stocks price.

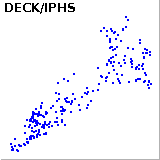

Let's take as an example some of our stocks, starting from ADBE and FLS.

If we represent on a chart the prices of ADBE and FLS as points over one year (axys X is ADBE price and axys Y is FLS price) we see that these points lay on a sort of a line. Correlation for ADBE and FLS is 91%, meaning that they move in a very similar way. ADBE goes up, then FLS goes up too.

Let's look now at the correlation between AFAM and DECK.

In this case a linear pattern cannot be identifies. In fact the correlation factor in this case is around 7%.

As a further example let's have a look at the correlation between IPHS and some other of our stocks:

If we consider all the correlation factors in our portfolio we get an average correlation of 62%.

From sone research I did it seems like a good portfolio mix has a correlation between -80% and 80%. But, of course, I would like to read your comments on this.

Sunday, May 10, 2009

Current Portfolio

| Symbol | Last Trade | Price Paid | Gain/Loss % | Stop Loss |

| ADBE | $25.42 | $18.70 | 35.93 | $23.32 |

| ADM | $26.97 | $25.40 | 6.18 | $23.20 |

| AFAM | $31.55 | $17.41 | 81.21 | $21.22 |

| DECK | $59.00 | $50.81 | 16.11 | $54.23 |

| ENDP | $16.34 | $17.38 | -5.99 | $14.89 |

| FLR | $45.17 | $37.99 | 18.89 | $36.61 |

| FLS | $74.38 | $52.57 | 41.48 | $59.19 |

| GIGM | $6.43 | $6.53 | -1.53 | $5.64 |

| IPHS | $15.81 | $9.47 | 66.94 | $12.21 |

| MVL | $33.24 | $24.35 | 36.50 | $27.35 |

| NCTY | $9.24 | $9.30 | -0.65 | $8.10 |

| NE | $30.90 | $24.39 | 26.69 | $26.04 |

| NRG | $21.19 | $18.98 | 11.64 | $16.35 |

| RECN | $19.77 | $14.04 | 40.81 | $16.49 |

| TRLG | $21.97 | $10.53 | 108.64 | $14.01 |

| VPHM | $6.03 | $4.71 | 28.02 | $4.82 |

| WDC | $23.71 | $16.20 | 46.35 | $20.51 |

Thursday, May 7, 2009

GIGM to watch

GIGM looks interesting. I am currently watching it and may decide to buy it soon.

Happy trading from

Humble Trader

UPDATE

I am going to buy GIGM today with an initial stop loss at $5.64

Wednesday, May 6, 2009

Good news for our AFAM and TRLG

We bought them cheap last month (AFAM at $17.41 - now around $30 - and TRLG at $10.53 - now around $20) and we are now in a very positive territory.

Tuesday, May 5, 2009

Updated Stop Loss

ADBE: stop loss $23.14

ADM: stop loss $23.20

AFAM: stop loss $20.83

DECK: stop loss $54.59

ENDP: stop loss $14.89

FLR: stop loss $36.61

FLS: stop loss $58.45

IPHS: stop loss $11.99

MVL: stop loss $26.77

NCTY: stop loss $8.10

NE: stop loss $25.42

NRG: stop loss $16.35

RECN: stop loss $16.02

TRLG: stop loss $12.97

VPHM: stop loss $4.71

WDC: stop loss $20.09

ADM missed the Street estimates

ADM missed the estimates. It will go down today. How much? Hard to tell.

It is a bad quarter, but the trailing twelve months performance is not bad at all.

I would suggest to keep the current stop loss at $23.20.

IPHS

From August 2008 to March 2009 IPHS decline from over $40 to less than $8.

During this dive it continued to make money and its PE ratio became more and more interesting.

In addition to that, from March 2nd 2009 my humble system started to tell me to watch IPHS for a possible trend inversion.

As I said, the signal arrived on March 17th and I was able to buy IPHS at $9.47. IPHS posted very good results yesterday, better than forecasts, and it gained 11%, closing over $17.

Analyzing IPHS fundamentals we see that it has an excellent value: very low PE and Price to Cash Flow, low Price Sales and average Price Book.

It still has good Current and Quick ratios, but it is using debt quite aggressively, compared to the industry average.

Finally it has first class profitability, growth and management effectiveness (best ROE in industry).

So the question is: should you buy IPHS? I would say "No". It may even go back to $40 and over, but IMHO buying IPHS now may be risky. Let's keep a stop loss on it at $11.93.

Current Portfolio

| Symbol | Last Trade | Price Paid | Gain/Loss % | Stop Loss |

| ADBE | $26.69 | $18.70 | 42.72 | $23.08 |

| ADM | $26.17 | $25.40 | 3.03 | $23.20 |

| AFAM | $25.96 | $17.41 | 49.10 | $20.75 |

| DECK | $59.10 | $50.81 | 16.31 | $54.23 |

| ENDP | $16.56 | $17.38 | -4.72 | $14.89 |

| FLR | $40.77 | $37.99 | 7.31 | $35.68 |

| FLS | $70.95 | $52.57 | 34.96 | $58.23 |

| IPHS | $17.12 | $9.47 | 80.78 | $11.93 |

| MVL | $31.10 | $24.35 | 27.72 | $26.83 |

| NCTY | $9.66 | $9.30 | 3.87 | $8.10 |

| NE | $30.21 | $24.39 | 23.86 | $25.21 |

| NRG | $19.48 | $18.98 | 2.63 | $16.35 |

| RECN | $20.01 | $14.04 | 42.52 | $15.78 |

| TRLG | $17.53 | $10.53 | 66.47 | $12.79 |

| VPHM | $5.42 | $4.71 | 15.28 | $4.71 |

| WDC | $24.26 | $16.20 | 49.75 | $19.86 |

Monday, May 4, 2009

Time to buy ADM

It looks like it is time to buy ADM. It has good PE/Price Book/Price Sales/Price Cashflow.

Good financial situation. Average profitability, but good effectiveness and growth.

I would suggest to buy it and set an initial stop loss order at $23.20.

Sunday, May 3, 2009

Current Portfolio

May 3rd 2009

| Symbol | Last Trade | Price Paid | Gain/Loss % | Stop Loss |

| ADBE | $27.46 | $18.70 | 46.79 | $22.84 |

| AFAM | $25.09 | $17.41 | 44.11 | $20.64 |

| DECK | $56.11 | $50.81 | 10.43 | $54.23 |

| ENDP | $16.51 | $17.38 | -5.00 | $14.89 |

| FLR | $37.73 | $37.99 | -0.68 | $35.68 |

| FLS | $69.81 | $52.57 | 32.79 | $57.82 |

| IPHS | $15.33 | $9.47 | 61.87 | $11.80 |

| MVL | $30.22 | $24.35 | 24.10 | $26.68 |

| NCTY | $9.35 | $9.30 | 0.53 | $8.10 |

| NE | $28.45 | $24.39 | 16.64 | $25.21 |

| NRG | $18.98 | $18.98 | - | $16.35 |

| RECN | $19.42 | $14.04 | 38.31 | $15.78 |

| TRLG | $16.88 | $10.53 | 60.30 | $12.79 |

| VPHM | $5.49 | $4.71 | 16.56 | $4.71 |

| WDC | $23.39 | $16.20 | 44.38 | $19.86 |

Saturday, May 2, 2009

Time to buy NRG

- NRG is in the cheapest 20% of its industry if analyzed on PE, Price/Book and Price/Cash Flow, and it has an average Price/Sales

- It has good Current and Quick Ratios, although it has a little high Debt/Equity Ratio

- Profitability is in the best 20% of its industry, as its ROI and ROE

- Finally, EPS and Sales Growth are better than industry average