Donations?

If you like this blog you can send it to a friend.

Thank you

Thursday, December 10, 2009

Account blocked again...

Friday, November 20, 2009

We bought and sold

Wednesday, November 18, 2009

LANC and VR

Tuesday, November 17, 2009

Some new buys

- LANC: $45.11

- GIGM: $3.75

- VR: $23.39

Friday, November 13, 2009

My blog disappeared...

Sunday, November 8, 2009

LHCG sold and new stop loss orders

Thursday, October 29, 2009

New stop loss orders

LHCG: $29.01

Two new sells for us

Tuesday, October 27, 2009

Sunday, October 25, 2009

We closed WDC

Thursday, October 22, 2009

Updated Stop Loss Orders

BUCY: $33.83

ENDP: $22.45

EROC: $4.22

LHCG: $28.73

WDC: $35.28

Friday, October 16, 2009

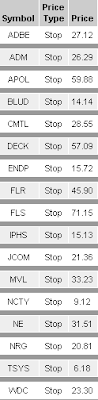

New Stop Loss Orders

WDC: $35.13

Wednesday, October 14, 2009

News on EROC

Wednesday, October 7, 2009

A loss with CSKI and quick message

Wednesday, September 30, 2009

Updated Stop Loss Orders

- APOL: $64.94

- BUCY: $30.33

- CSKI: $12.81

- ENDP: $21.88

- EROC: $3.47

- LHCG: $26.37

- WDC: $33.60

Friday, September 25, 2009

Updated stop loss orders

BUCY: $29.88

CSKI: $12.81

ENDP: $21.87

EROC: $3.35

LHCG: $25.57

WDC: $33.37

Thursday, September 24, 2009

Tuesday, September 22, 2009

Let's wait with DBA + quick update

I would suggest to cancel our order and wait.

Quick update

Good news for two of our stocks. APOL gained 8% yesterday on no particular news (unless I missed something). It is a good thing, since APOL had been moving sideway since we bought it.

EROC also gained 8% yestarday. This is a quite volatile stock and we will raise our stop loss soon in order to prevent bad surprises.

On the other hand, we own a loser (MIR) that I actually expected to perform better. Let's keep our current stop for MIR and let's hope it starts moving up.

Our latest buy, CSKI, is not moving much at the moment, but I would expect a big move soon (hopefully upward).

Monday, September 21, 2009

New Stop Loss Orders

A question worthing an answer

| How do you recommend allocating the money for each stock? |

That's avery good question and books have been written about portfolio allocation. My approach is to allocate my portfolio in a way that statistically (or usually) works.

Let's take our current portfolio and look at our stocks' industries:

- APOL: Services: Schools

- BUCY: Capital Goods: Constr. & Agric. Machinery

- CSKI: Healthcare: Biotechnology & Drugs

- ENDP: Healthcare: Biotechnology & Drugs

- EROC: Energy: Oil & Gas Operations

- LHCG: Healthcare: Healthcare Facilities

- MIR: Utilities: Electric Utilities

- WDC: Technology: Computer Storage Devices

We currently own only two stocks in the same industry: CSKI and ENDP that are in the Biotechnology & Drugs industry.

As a very generic rule, differentiating industries reduces the risk. Think of the Energy sector, Oil Well Services & Equipment industry from May to December 2008.

This industry lost 60% when the S&P500 lost only 36%. A mixed portfolio would have lost 35-40% while an Energy-Oil based portfolio would have lost 60% of its value.

Thesame for Basic Materials: Metal Mining from May to October 2008. The industry lost 66% against a 30% loss of S&P500. More than double.

It is true that in some circumstances an unbalanced portfolio may be a good thing. Suppose a particular industry gets severily hit by news, recession or whatever you want at the point that its average PE ratio goes down to 5. That is a good time to buy all the best companies in that industry, even if we end up with half of our portfolio in that specific industry. Our stop losses will keep us safe anyway...

What I like to use on my portfolio is a correlation test. I like to have stocks that behaved differently in the last 12 months. That reduces the risk of seeing my portfolio taking a unique (downward) direction. Let me take a couple of examples:

If we calculate the correlation between END and EROC over the last 12 months we get a 0.4%. That means these two stocks moved independently over 99% of the times.

LHCG and MIR show a correlation of 42%, meaning that almost every second day their prices moved the same way.

An experimental web page calculating correlation can be found here (beware: it is very slow).

Another point to cover is "how many stocks should our portfolio have"? I usually buy stocks for 5% of my portfolio value, so to equally balance my investments amongst 20-30 stocks. OK, I know you are thinking "5% times 30 makes 150%". Usually I own 15 to 20 stocks (thus keeping 25% of cash). In very good time I use margin and invest over 100% of my money. This adds risk but sometimes it can be done (always using stop losses).

A final note: I am not a professional trader. I like to invest abd I like to share my ideas. You do not neccessarily need to agree with my opinions and you do not have to follow my hints.

Happy trading

Friday, September 18, 2009

CMTL sold

Have a nice week-end and see you soon for the new stop loss prices.

Thursday, September 17, 2009

Two "risky" buys

CSKI

It shows a technical buy signal and it has good fundamentals. But it is a Chinese stock, so I would recomment to pay particular attention to it, since Chinese stocks are usually very volatile.

DBA

It lost quite a lot and looks like having found a good support. Technical indicators show a probable big change in price.

As always I would suggest to set a 1% trailing stop buy orders at 10 o'clock, after the first 30 minuts of trading.

Please note: I consider these two trades riskier than usual so I recomment to use stop losses, beginning with:

CSKI: initial stop at $12.81

DBA: initial stop at $23.03

New stop loss prices, a question and the strange case of MAXY

I sold MAXY, but I did not want to. Let me explain: I use eTrade for my trading and there is a technical detail that made me sell MAXY yesterday. eTrade uses Ask Prices for buy orders and Bid Prices for sell orders. So, since MAXY's Bid Price went under $6.63 my order was executed at $6.83. The day low was $6.75, thus higher than our stop loss level. I do not know if other trading platform manage stop loss orders in a different way, but I consider this as an accident that can happen.

The bottom line is that I take home a 9.5% loss on MAXY. If you still have it, keep the stop at $6.63.

Current portfolio and updated stop loss prices

The new stop prices I would suggest are:

- APOL: Stop at $61.14

- BUCY: Stop at $29.13

- CMTL: Stop at $33.27

- ENDP: Stop at $21.66

- EROC: Stop at $3.23

- LHCG: Stop at $24.02

- MIR: Stop at $15.75

- WDC: Stop at $32.30

The question

I received the following question in a comment:

Quick question, how effective are stop losses? I assume you're putting a stop limit on these prices, but on some of the riskier stocks, if the stock opens up really low, the stock will automatically sell. Is that a good strategy?

I try to answer, but my opinion is not necessary matching your idea.

Stop Losses are statistically effective. I mean they usually work. I read books and made simulations and I found the method I use to calculate stop losses works well (on average). It happens stop losses are violated and stocks are sold, and after that they continue to go up. For me it is just part of the game.

There are basically two ways to manage stop losses:

- Set stop loss orders (this is what I do). If the price goes down during the day the order is executed automatically. Then the price can go up again in a dragonfly doji.

- Simulate stop losses. Set alerts on stocks at the stop loss level you want. If the price goes down you get an email. At the end of the day you check. If the close price is below your stop loss then you sell the following day on open. What I don't like in this approach is that a stock it may happen to lose 30% in a day. If you use this method you sell the day after losing 30%, while with method 1 you sell during the day when you lose, let's say, 15%.

Your choice. I hope this can be of any use for you.

Monday, September 14, 2009

New buys

WHAT?

I would sugegst to buy the following stocks: BUCY, EROC and MIR.

WHY?

These three stocks showed a technical buy signal in the last couple of days. In addition to that, their fundamentals are good compared to industry average.

BUCY

Financials

- Average quick and current ratios

- Low debt

Value

- Low PE and Price/Cash Flow

Profitability

- Top Operating and EBIDTA margins

Effectiveness

- Top ROI, ROE and ROA

Growth

- Good EPS and Sales growth

EROC

Financials

- Good quick and current ratios

- Debt is higher than average (some risk here - never forget stop loss)

Value

- Low PE, Price/Sales and Price/Book

Profitability

- Top Operating Margin and good EBIDTA

Effectiveness

- Top ROI, ROE and ROA

Growth

- Top EPS and Sales growth

MIR

Financials

- Good quick and current ratios

- Very low debt

Value

- Low PE, Price/Sales, Price/Book and Price/Cash Flow

Profitability

- Top Operating and EBIDTA margins

Effectiveness

- Top ROI, ROE and ROA

Growth

- Top EPS and Sales growth

HOW?

I would suggest to place a 1% trailing stop buy order.

WHEN?

I would suggest to create the orders at 10 o'clock. In these way we will wait for the first 30 crazy minutes of the day.

THEN?

As soon as we buy I would suggets the following initial stop loss prices:

- BUCY: stop loss at $27.93

- EROC: stop loss at $3.11

- MIR: stop loss at $15.75

Current Portfolio and Update Stop Loss Orders

Current Portfolio

Stop Loss Orders

- APOL: stop at $61.14

- CMTL: stop at $32.98

- ENDP: stop at $21.07

- LHCG: stop at $23.35

- MAXY: stop at $6.63

- WDC: stop at $31.55

Monday, September 7, 2009

A new buy and some new stop loss

Actually we should have bought it last Friday (September 4th) but I was not in front of my computer that day.

We can buy it now, or better, tomorrow, since today is Labor Day.

MAXY show a very goos PE ratio, averagePrice/Sales and good Price/Book.

It has no debt and very goos quick and current ratio (cash in pocket).

Operating margin and EBITDA are in Industry's best 20%, as ROI/ROE are.

This stock should offer us a good margin of safety.

I would suggest to set a buy order as a trailing stop at 1% (as an alternative, just buy it on market open) and set an initial stop loss at $6.63.

Updated Stop Loss Orders

- APOL Stop at $61.14

- CMTL Stop at $32.61

- ENDP Stop at $20.92

- LHCG Stop at $23.32

- WDC Stop at $31.04

- MAXY Stop at $6.63

Wednesday, September 2, 2009

Disappointing TSYS

We bought TSYS on 05/19/09 at $7.54 and sold it on 09/01/09 at $7.21 for a 4.36% loss.

A comment on markets

S&P500 looks like forming a head and shoulder pattern. It may go down to 980 points. Then what happens? If it goes below 980 a new down trend may last for weeks/months. If it goes back up, rebounding, it may close the head and shoulder at around 1010 before going down again. The situation is very uncertain.

I would wait to see if S&P500 goes over 1015 before buying anything else...

Tuesday, September 1, 2009

New stop loss orders

- CMTL: $32.33

- ENDP: $20.73

- WDC: $30.64

- TSYS: $7.24

- APOL: $61.14

- LHCG: $22.15

Monday, August 31, 2009

New Stop Loss Orders

The market is pointing down today.

It is a good time to update our stop loss orders.

- CMTL Stop at $32.20

- ENDP Stop at $20.64

- TSYS Stop at $7.24

- WDC Stop at $30.53

No need to change our latest additions' stop loss levels

- APOL Stop at $61.14

- LHCG Stop at $22.15

Friday, August 28, 2009

New buy: APOL

- No debt, average quick and current ratios (1.40) in industry

- Better than industry average P/E

- Very good profitability (Operating and EBITDA margins in industry's best 20%)

- Very good ROE/ROI compared to industry

- Good EPS and Sales growth

- Stochastic oscillator gave a buy signal, confirmed by the Exponential Moving Average (20 days) crossing.

Wednesday, August 26, 2009

New buy and Updated watchlist

I would suggest to buy LHCG today (August 26th 2009). Here's why:

From a fundamental point of view, LHCG show the following

- better than industry PE ratio

- good quick and current ratio and low short and long term debt make it financially solid

- good margins, good return on invested capital and on equity

- good growth

I would suggest an initial stop loss price of $22.15.

Watchlist

In addition to our previous stocks to watch:

- ASEI

- AZZ

- BKR

- CBST

- CTR

- EROC

- EVEP

- IPHS

- MAXY

- MIR

- PETM

I would add the following:

- AGNC

- AIPC

- APOL

- BMY

- BUCY

- CHBT

- CMCSA

- CPHI

- CSKI

- DRC

- EBS

- ENSG

- PIKE

- POWL

- RIMM

- SMLC

- STRL

- VAR

Please note: these are stocks to watch, not necessarily to buy (at least not now)

Monday, August 24, 2009

Watchlist and new stop loss orders

I would monitor the following stocks:

- ASEI

- AZZ

- BKR

- CBST

- CTR

- EROC

- EVEP

- IPHS

- MAXY

- MIR

- PETM

Stop loss

- CMTL $31.69

- ENDP $20.10

- TSYS $7.22

- WDC $29.84

Thursday, August 20, 2009

A quick update

just a few words, while we prepare for the next round.

Current Portfolio

We have only 4 stocks in our portfolio at the moment:

- CMTL

Current: $33.99

Payed: $28.99

G/L: 17.04%

Stop: $31.52 - ENDP

Current: $21.505

Payed: $17.38

G/L: 23.47%

Stop: $19.63 - TSYS

Current: $7.30

Payed: $7.5385

G/L: -3.36%

Stop: $7.12 - WDC

Current: $32.45

Payed: $16.20

G/L: 99.82%

Stop: $29.52

Closed Positions

- DECK: $50.81 to $54.23 - 6.7% gain

- AFAM: $17.41 to $26.09 - around 49% gain

- RECN: $14.04 to $17.21 - 22% gain

- GHM: $15.57 to $12.60 - 19% loss

- GIGM: $6.53 to $5.64 - 13% loss

- TRLG: $10.53 to $20 - 89% gain

- VPHM: $4.71 to $5.69 - 20% gain

- IPHS: $9.47 to $15.12 - 59% gain

- NE: $24.39 to $31.52 - 29% gain

- ADM: $25.40 to $26.29 plus 14cts dividends - 4% gain

- FLS: $52.57 to $71.17 plus 54 cst dividends - 36% gain

- JCOM: $22.23 to $21.50 - 3.3% loss

- BLUD: $16.53 to $11.71 - 29% loss

- NCTY: $9.64 to $9.58 - 0.6% loss

- FLR: $37.99 to $47.24 - 24% gain

- ADBE: $18.70 to $27.12 - 45% gain

- DECK again: $57.08 to $64.18 - 12.4% gain

- APOL $62.87 to $64.7 - 2.9% gain

- DISH: $15.89 to $14.33 - 10% loss

- NRG: $19.56 to $22.3 - 14% gain

- MVL: $24.35 to $37.87 - 55% gain

I plan to build a new watchlist in the next couple of days.

Wednesday, August 19, 2009

Coming back

In fact my family grew a few weeks ago and I had to work night and day to take care of my newly arrived little lady.

It is now time to restart our trading activity. In the meanwhile, after DECK, ADBE and FLR, we sold APOL, DISH, NRG and MVL.

I am sorry I did not post the updated stop loss prices, but if you followed my free stop loss calculator you should have sold at prices similar to mine.

Let's quickly review our last trades:

- We sold APOL at $64.7 on July 13th. We bought it at $62.87 on May 19th for a modest 2.9% gain.

- Bad luck with DISH. We bought it at $15.89 and sold it at $14.33 for a 10% loss. It then went over $19, but I really had no time to follow it.

- We sold NRG at $22.3 on July 21st, after having bought it at $19.56 on May 4th for a 14% gain.

- Finally, on August 17th we sold MVL at $37.87. We bought it on March 24th at $24.35 for a good 55% gain.

On average we made a 15% gain on these four trades.

That's all for now. Hopefully this week i will be able to analyze some new stocks. But at the same time let' keep an eye on the markets. They look very uncertain to me...

Friday, July 10, 2009

DECK sold

We bought it on May 29th at $57.08 and our total gain was 12.4%.

From March to May 2009 we already traded DECK for a 6.7% gain.

Wednesday, July 8, 2009

A couple of sell and new stop losses

We bought FLR on March 11th at $37.99 and sold it on July 6th at $47.24 for a 24% gain.

And we bought ADBE on March 11th too at $18.70 and sold it again on July 6th at $27.12 for a 45% gain.

Our current portfolio, with updated stop loss levels is as follows:

APOL Stop at $63.02

CMTL Stop at $29.25

DECK Stop at $64.26

DISH Stop at $14.25

ENDP Stop at $16.80

MVL Stop at $34.66

NRG Stop at $21.93

TSYS Stop at $6.18

WDC Stop at $24.11

Thursday, July 2, 2009

Some loss with NCTY

We bought NCTY on April 30th at $9.64 and sold it at $9.58 for a 0.6% loss (plus some commissions).

This was my 3rd trade with NCTY. The other 2 were closed before I started this blog:

I bought NCTY on April 22nd 2008 at $20.35 and sold it on June 18th 2008 at $24.21 (18.9% gain) and bought it again on July 8th 2008 at $24.45 and sold it on July 24th 2008 at $24.75 (1% gain).

New stop loss prices for some of our stocks

MVL Stop at $34.34

NRG Stop at $21.92

WDC Stop at $23.87

Wednesday, July 1, 2009

Portfolio, Performance and Stop Loss

This post is in some way a kind of a mid-year review of our performance.

I started publishing my trades in April, but I think it is fair to share my Year-To-Date performance.

I would like to start with our current portfolio, updated on June 30th 2009, after market close:

We currently have around 50% cash, since the market is still uncertain.

New stop loss prices have been calculated for the stocks we currently own, as follows:

Monday, June 29, 2009

New Stop Loss and Updated Track Record

New Stop Loss Prices

ADBE Stop at $27.13

APOL Stop at $61.73

CMTL Stop at $28.78

DECK Stop at $62.03

ENDP Stop at $15.72

FLR Stop at $47.19

MVL Stop at $34.01

NCTY Stop at $9.49

NRG Stop at $21.70

TSYS Stop at $6.18

WDC Stop at $23.48

You can calculate your stop losses for free here

Updated track record.

| Stock | Buy Price | Sell Price | Gain (Loss) |

| AFAM | $17.41 | $26.09 | 49.86% |

| DECK | $50.81 | $54.23 | 6.73% |

| GHM | $15.57 | $12.60 | -19.08% |

| GIGM | $6.53 | $5.64 | -13.63% |

| TRLG | $10.53 | $20.00 | 89.93% |

| VPHM | $4.71 | $5.69 | 20.81% |

| RECN | $14.02 | $17.21 | 22.75% |

| NE | $24.39 | $31.52 | 29.23% |

| IPHS | $9.47 | $15.12 | 59.66% |

| ADM | $25.40 | $26.29 | 3.50% |

| FLS | $52.57 | $71.17 | 35.38% |

| JCOM | $22.23 | $21.50 | -3.28% |

| BLUD | $16.53 | $11.71 | -29.16% |

Dividends are not considered in the above calculation.

- 69% (9 out of 13) of our trades were winning trades

- average gain for winning trades was 35.32%

- average loss for losers was 16.29%

- Average return of the 13 trades: 19.44%

Friday, June 26, 2009

Bad bad BLUD

We bought it at $16.53 and jyst sold it at $11.71 for an unpleasant 29% loss.

Our worse trade so far.

Thursday, June 25, 2009

JCOM sold and summary

Buy price was $22.23 on May 29th and sell price was around $21.50 today, for a 3.3% loss. Let's update our track record now.

| Stock | Buy Price | Sell Price | Gain (Loss) |

| AFAM | $17.41 | $26.09 | 49.86% |

| DECK | $50.81 | $54.23 | 6.73% |

| GHM | $15.57 | $12.60 | -19.08% |

| GIGM | $6.53 | $5.64 | -13.63% |

| TRLG | $10.53 | $20.00 | 89.93% |

| VPHM | $4.71 | $5.69 | 20.81% |

| RECN | $14.02 | $17.21 | 22.75% |

| NE | $24.39 | $31.52 | 29.23% |

| IPHS | $9.47 | $15.12 | 59.66% |

| ADM | $25.40 | $26.29 | 3.50% |

| FLS | $52.57 | $71.17 | 35.38% |

| JCOM | $22.23 | $21.50 | -3.28% |

Dividends are not considered in the above calculation.

- 75% (9 out of 12) of our trades were winning trades

- average gain for winning trades was 35.32%

- average loss for losers was 12.00%

- Average return of the 12 trades: 23.49%

Tuesday, June 23, 2009

FLS sold

We bought it on March 11 at $52.57. We got 27 cents at the end of March and 27 cents in these days.

We sold FLS today at around $71.17 for a total 36% gain.

ADM sold

We bought it on May 4th at around $25.40.

That makes a 3.5% gain, but ADM also gave us some dividends on June 12th for 14 cents per share (0.5%).

Our total gain is then around 4%. Better than nothing...

NE and IPHS sold

We bought NE on March 16th 2009 at around $24.39 and sold it yesterday June 22nd at around $31.52 for a 29% gain.

IPHS was bought on march 18th at around $9.47 and sold on June 22nd at around $15.12 for a 59% gain.

Monday, June 22, 2009

Wednesday, June 17, 2009

Results

From the date I opened this blog (April 2009) we closed 7 trades:

| Stock | Buy Price | Sell Price | Gain (Loss) |

| AFAM | $17.41 | $26.09 | 49.86% |

| DECK | $50.81 | $54.23 | 6.73% |

| GHM | $15.57 | $12.60 | -19.08% |

| GIGM | $6.53 | $5.64 | -13.63% |

| TRLG | $10.53 | $20.00 | 89.93% |

| VPHM | $4.71 | $5.69 | 20.81% |

| RECN | $14.02 | $17.21 | 22.75% |

On these 7 trades we have 2 losers and 5 winners and, except for DECK, our winners gained more than what our losers lost. That is a benchmark I like:

- 70% winning trades

- 17% average loss for losers

- 38% average gain for winners

Our average gain on these 7 trades is: 22.48%.

Why don't you share this blog with some friends?

VPHM sold

We bought on March 27th at $4.71 and sold it today at $5.69 for a 20% gain.

Stop Loss

ADBE stop at $26.67

ADM stop at $26.29

APOL stop at $59.31

BLUD stop at $14.14

CMTL stop at $28.26

DECK stop at $54.35

ENDP stop at $15.72

FLR stop at $45.02

FLS stop at $70.39

IPHS stop at $15.06

JCOM stop at $21.16

MVL stop at $32.44

NCTY stop at $9.12

NE stop at $30.89

NRG stop at $20.14

TSYS stop at $6.18

VPHM stop at $5.61

WDC stop at $23.07

Tuesday, June 16, 2009

TRLG sold

New Stop Loss

- ADBE: stop at $26.41

- ADM: stop at $25.96

- APOL: stop at $57.89

- BLUD: stop at $14.14

- CMTL: stop at $28.16

- DECK: stop at $53.54

- ENDP: stop at $15.72

- FLR: stop at $44.67

- FLS: stop at $69.99

- IPHS: stop at $14.72

- JCOM: stop at $21.14

- MVL: stop at $32.22

- NCTY: stop at $9.11

- NE: stop at $30.60

- NRG: stop at $19.94

- TRLG: stop at $20.04

- TSYS: stop at $6.18

- VPHM: stop at $5.61

- WDC: stop at $22.60

Monday, June 15, 2009

Updated Stop Loss

ADM Stop at $25.96

CMTL Stop at $28.16

DECK Stop at $52.70

FLR Stop at $44.24

FLS Stop at $69.24

JCOM Stop at $21.14

MVL Stop at $31.96

NCTY Stop at $9.06

NE Stop at $30.18

NRG Stop at $19.77

APOL Stop at $56.17

BLUD Stop at $14.14

ENDP Stop at $14.89

IPHS Stop at $14.16

TRLG Stop at $20.04

TSYS Stop at $6.18

VPHM Stop at $5.60

WDC Stop at $22.60

GIGM sold with loss

It broke its stop loss so we sold it.

Buy price was around $6.53 and sell price around $5.64 for a 13% loss.

Monday, June 8, 2009

Updated Stop Loss

ADBE $25.44

ADM $25.34

APOL $56.17

BLUD $14.14

CMTL $27.47

DECK $49.27

ENDP $14.89

FLR $42.57

FLS $66.99

GIGM $5.64

IPHS $14.16

JCOM $20.07

MVL $31.08

NCTY $8.92

NE $28.93

NRG $18.64

TRLG $20.04

TSYS $6.18

VPHM $5.60

WDC $22.60

Thursday, June 4, 2009

Updated Stop Loss Orders

June 4th 2009

ADBE Stop at $25.26

ADM Stop at $25.13

APOL Stop at $56.17

BLUD Stop at $14.14

CMTL Stop at $26.37

DECK Stop at $49.27

ENDP Stop at $14.89

FLR Stop at $42.19

FLS Stop at $66.57

GIGM Stop at $5.64

IPHS Stop at $14.16

JCOM Stop at $20.07

MVL Stop at $30.94

NCTY Stop at $8.92

NE Stop at $28.47

NRG Stop at $18.64

TRLG Stop at $20.04

TSYS Stop at $6.18

VPHM Stop at $5.60

WDC Stop at $22.60

Wednesday, June 3, 2009

New Buys: BLUD and CRY

BLUD: initial stop loss at $14.14

CRY: initial stop loss at $4.45

Monday, June 1, 2009

GHM sold

Portfolio and Stop Loss

| Symbol | Last Trade | Price Paid | Total Gain % | Stop Loss |

| ADBE | 28.18 | $18.70 | 50.34 | $25.03 |

| ADM | 27.52 | $25.40 | 8.13 | $24.58 |

| APOL | 59.10 | $62.87 | -6.18 | $55.34 |

| CMTL | 29.14 | $28.99 | 0.31 | $26.37 |

| DECK | 57.96 | $57.08 | 1.34 | $49.27 |

| ENDP | 15.93 | $17.38 | -8.54 | $14.89 |

| FLR | 46.98 | $37.99 | 23.39 | $40.70 |

| FLS | 73.57 | $52.57 | 39.62 | $65.58 |

| GHM | 14.00 | $15.57 | -10.26 | $12.65 |

| GIGM | 6.05 | $6.5288 | -7.52 | $5.64 |

| IPHS | 15.59 | $9.4672 | 64.33 | $13.64 |

| JCOM | 22.30 | $22.23 | 0.12 | $19.96 |

| MVL | 33.18 | $24.35 | 35.95 | $30.42 |

| NCTY | 9.14 | $9.638 | -5.36 | $8.10 |

| NE | 34.37 | $24.39 | 40.63 | $28.01 |

| NRG | 22.50 | $19.56 | 14.81 | $18.53 |

| TRLG | 23.06 | $10.53 | 118.57 | $19.55 |

| TSYS | 7.46 | $7.5385 | -1.24 | $6.18 |

| VPHM | 6.95 | $4.7096 | 47.26 | $5.40 |

| WDC | 24.85 | $16.20 | 53.02 | $22.42 |

Friday, May 29, 2009

New Buys: DECK and JCOM

I would suggest to buy DECK again and also JCOM.

We sold DECK some time ago because it broke our stop loss at around $54.50. It is currently higher, but still with good fundamentals.

I would suggest an initial stop loss at $49.27

JCOM is new for us. It is a little expensive, with a PE ratio a little higher than its industry average. It also has an average growth rate, but has high ROI/ROE, high profit margins and a strong financial position.

I would suggest an initial stop loss at $19.96

Wednesday, May 27, 2009

New buy: GHM and CMTL

Tuesday, May 26, 2009

Unlucky with RECN

Today RECN opened very low, below our stop loss level and we sold it.

Sell price was the low of the day at $17.21 while it is now trading at $18.52.

Anyway, we bought RECN on March 11th at $14.04 and, although we could have done better, we cashed in a 22% in two months and a half.

Stop Loss

ADBE: $24.79

ADM: $24.27

APOL: $55.34

ENDP: $14.89

FLR: $39.48

FLS: $63.94

GIGM: $5.64

IPHS: $13.41

MVL: $29.80

NCTY: $8.10

NE: $27.52

NRG: $17.86

RECN: $17.54

TRLG: $18.51

TSYS: $6.18

VPHM: $5.24

WDC: $21.90

Thursday, May 21, 2009

AFAM sold

Wednesday, May 20, 2009

New Buys: TSYS and APOL

Monday, May 18, 2009

Updated Stop Loss Orders

ADM: $23.20

AFAM: $26.09

ENDP: $14.89

FLR: $38.09

FLS: $60.50

GIGM: $5.64

IPHS: $13.02

MVL: $28.27

NCTY: $8.10

NE: $26.48

NRG: $17.36

RECN: $17.17

TRLG: $17.66

VPHM: $4.96

WDC: $20.87

Wednesday, May 13, 2009

Calculate Stop Loss Prices

http://spiderman.servehttp.com/stop.jsp

NOTE: update your stop losses ONLY UPWARD.

DECK losing ground

It seems like selling DECK yesterday was not a bad idea.

It is currently trading under $52.

Updated Stop Loss

ADBE $23.40

ADM $23.20

AFAM $21.83

ENDP $14.89

FLR $36.61

FLS $59.92

GIGM $5.64

IPHS $12.60

MVL $27.79

NCTY $8.10

NE $26.37

NRG $17.28

RECN $16.69

TRLG $14.39

VPHM $4.86

WDC $20.67

Tuesday, May 12, 2009

DECK violated its stop loss

We bought it at $50.81, so we gained only a 6.7% with it.

What's next? Who knows... maybe DECK will skyrocket now or maybe it will move sideways for a while.

We will watch it and may buy it again, since its fundamentals are still good.

An update on Stop Loss orders

In this volatile market we should pay attention to protect our gains, specially for those positions on which we are gaining well.

In this volatile market we should pay attention to protect our gains, specially for those positions on which we are gaining well.Let's take our four best performers: TRLG (up 105%), AFAM (up 81%), IPHS (up 61%) and WDC (up 42%).

I would suggest to:

- Almost Family, Inc. (AFAM) move the stop loss from $21.22 to $21.45

- Innophos Holdings, Inc. (IPHS) move the stop loss from $12.21 to $12.60

- True Religion Apparel, Inc. (TRLG) move the stop loss from $14.01 to $14.37

- WESTERN DIGITAL CP (WDC) move the stop loss from $20.51 to $20.52

Monday, May 11, 2009

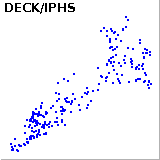

Correlation - Is our portfolio well diversified?

We can use correlation to evaluate how our stocks are prone to move together.

A well differentiated portfolio should have stocks that do not behave the same over time. Every day we should own stocks that win and stocks that lose (ideally more of the former and les of the latter) so that on average we gain more than the market in good times and lose less than the market in bad times.

Two stocks are perfectly correlated if there is a linear relation between them. Let's suppose to own stock A and stock B. If stock B gains X% everytime stock A gains X%, and stock B loses X% everytime stock A loses X%, then stock A and stock B have a correlation factor of 1. The same if stock B gains/loses 2, 3, 4 or n times X%. There is a linear dependency between the two stocks price.

Let's take as an example some of our stocks, starting from ADBE and FLS.

If we represent on a chart the prices of ADBE and FLS as points over one year (axys X is ADBE price and axys Y is FLS price) we see that these points lay on a sort of a line. Correlation for ADBE and FLS is 91%, meaning that they move in a very similar way. ADBE goes up, then FLS goes up too.

Let's look now at the correlation between AFAM and DECK.

In this case a linear pattern cannot be identifies. In fact the correlation factor in this case is around 7%.

As a further example let's have a look at the correlation between IPHS and some other of our stocks:

If we consider all the correlation factors in our portfolio we get an average correlation of 62%.

From sone research I did it seems like a good portfolio mix has a correlation between -80% and 80%. But, of course, I would like to read your comments on this.

Sunday, May 10, 2009

Current Portfolio

| Symbol | Last Trade | Price Paid | Gain/Loss % | Stop Loss |

| ADBE | $25.42 | $18.70 | 35.93 | $23.32 |

| ADM | $26.97 | $25.40 | 6.18 | $23.20 |

| AFAM | $31.55 | $17.41 | 81.21 | $21.22 |

| DECK | $59.00 | $50.81 | 16.11 | $54.23 |

| ENDP | $16.34 | $17.38 | -5.99 | $14.89 |

| FLR | $45.17 | $37.99 | 18.89 | $36.61 |

| FLS | $74.38 | $52.57 | 41.48 | $59.19 |

| GIGM | $6.43 | $6.53 | -1.53 | $5.64 |

| IPHS | $15.81 | $9.47 | 66.94 | $12.21 |

| MVL | $33.24 | $24.35 | 36.50 | $27.35 |

| NCTY | $9.24 | $9.30 | -0.65 | $8.10 |

| NE | $30.90 | $24.39 | 26.69 | $26.04 |

| NRG | $21.19 | $18.98 | 11.64 | $16.35 |

| RECN | $19.77 | $14.04 | 40.81 | $16.49 |

| TRLG | $21.97 | $10.53 | 108.64 | $14.01 |

| VPHM | $6.03 | $4.71 | 28.02 | $4.82 |

| WDC | $23.71 | $16.20 | 46.35 | $20.51 |